Earlier this year I subscribed to a daily update from the great leadership teacher, John Maxwell. Each day, John teaches on a particular leadership topic (you can subscribe here and you really should). John usually has lots of great things to say, but this particular point really made me stop and think: “Average won’t cut it“.

Earlier this year I subscribed to a daily update from the great leadership teacher, John Maxwell. Each day, John teaches on a particular leadership topic (you can subscribe here and you really should). John usually has lots of great things to say, but this particular point really made me stop and think: “Average won’t cut it“.

That thought took me back a few years to a course on leadership (what else!). This particular course left a profound impact on me. The instructor shared the idea of “playing above the line“. This basically means that you will strive for excellence and take ownership of everything in your life. You won’t settle for just being average and just doing what everyone else does. You will choose to play above the line where everyone else stays. Others would not set the standard for you. If you were late for work or church, you would not blame the traffic like we tend to do. Traffic patterns rarely change, so you know better. You would instead say, “I did not plan adequately and I did not leave the house early enough.”

When you put this in terms of managing your finances, Dave Ramsey would call it being “weird” as opposed to being “normal“. Normal (or average) with finances in the good old USA is living paycheck to paycheck, drowning in credit card debt, carrying student loan debt for 10-15 years, having car payments or worse lease payments for at least 5 years, having no savings for college and no savings for retirement. The Normal (or average) person looks to Washington to rescue them from their financial mistakes (and we all have made them). Normal says: “it can’t be done”, “there is no way out”.

Normal (average) people watch too much Fox News and CNN and believe the story line of the day that we are mired in the worst economy recession of our lives. If that were true, summer “blockbuster” movies would not be making $100M on opening weekends. Or you would not have a long wait at the restaurant of choice and Starbucks would be out of business (people in a recession don’t need $5 coffee). People would not be spending an average of $50 to $100 per family to attend a baseball game. Apple would not be pushing a new iPad every other month (it seems that way anyway 🙂 ).

So what does it look like when you “play above the line” with your money? How can you be above average in your finances? What does it take to be weird in the land of normal?

Take Ownership

- Learn to create and live on a monthly spending plan. In other words, prepare a monthly budget every month before the month begins. Spend your money on paper. You tell your money where to go instead of wondering where it went (another great thought from Maxwell). And track your spending!

- Learn to identify wants vs. needs. Focus on the basic necessities of your household first and prioritize those first (food, shelter, clothing, transportation).

Plan for the Future

- Save for emergencies. At a minimum you need $1,000 in your beginner’s emergency fund. Later, you should build that up to 6 months of expenses.

- Get out of debt. You won’t be able to make much progress if all your money is going to pay everyone else but you!

- Start saving for retirement (after you get out of consumer debt). You need to build up to put away 15% of your gross income every year.

- Start saving for college (after you get out of consumer debt). If you have kids, you can pass on to them the great gift of going through college without student loans. It is possible!!!

- Pay off the mortgage. You don’t need a mortgage just because you want to keep a tax deduction. You can achieve the same deduction by increasing your charitable giving.

Love your Family Well

- Take care of your insurance needs: Life, Health, Home/Renters, Auto, Disability, Identity Theft, and Long Term Care (once you reach 60 years old). Transfer that risk to someone else!

- Get a will. It is simple and inexpensive. Don’t leave your family with the task of figuring out what to do with your stuff once you are gone. In the midst of mourning your passing, they can have the peace that there will be an orderly transition.

- Teach your kids about money. They need to know how to balance a checkbook. They need to know the value of earning money. They need to learn how to save and how to spend. They also need to learn and experience the joy of giving.

Playing above the line. Being above average or weird. I understand it is not easy. Some days it will be harder than other. You will be tempted to give in. But don’t. What is the option really? What choice do you have? If not you then who? If not now, when?

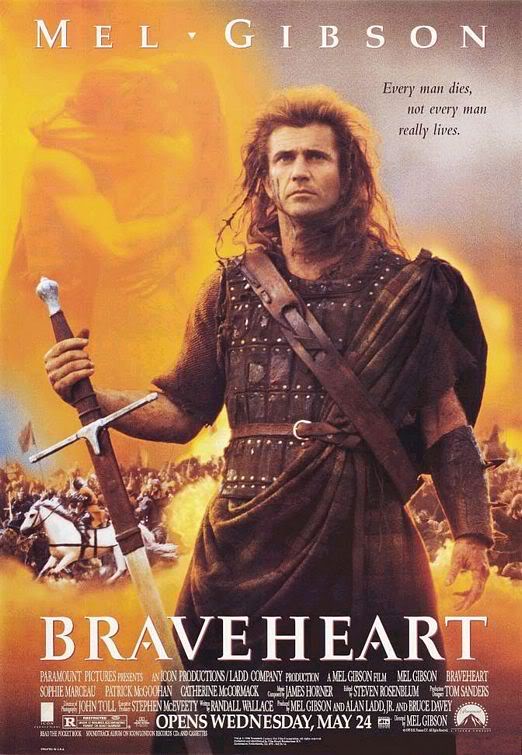

One of the great “guy movies” of all time is of course Braveheart. Towards the end of the movie, Sir William Wallace is facing execution. Princess Isabelle can’t bear the thought of him dying. In one of the great lines of the movie, he says: “Every man dies, not every man really lives.” Sir William Wallace had given his life for a noble and just cause. He gave the example of playing above the line and giving it your all.

So what choice will you make? Will you choose to take ownership of your finances or let everyone else set the standard for you? Will you choose to stay below the line or will you choose to live beyond mediocrity? Average won’t cut it. Normal won’t cut it. This country of ours is still the greatest country in the world. It is still the land of opportunity, the land of the free. But you have to brave. You have to be daring. You have to choose to be above average. Start today!