Have you ever been in that situation? I mean, you have worked on your budget, you have looked at every possible way to cut expenses.

And yet, you still don’t have enough money coming in this month to cover all the bills.

So what do you do? Of course one way to work on this is by increasing your income by working overtime or by taking a second job temporarily. But that may take a little while to setup and you still have to deal with this month.

As my mom would say, you have to find a way of stretching your dollar. So here are some reminders to help you deal with the challenge.

1. Remember to Protect the Four Walls

When your income is limited, prioritizing your spending becomes more critical. And you should always focus on protecting the four walls first.

What are the four walls? These are food, shelter/utilities, transportation, and clothing.

When there is food on the table and a roof over your head you can continue fighting. If the car payments are up to date and you have enough to fill up the tank, you can get to work and increase that income. And it’s a good thing to have basic clothing needs covered.

Money might still be tight but you can live to fight another day because the fundamental, basic needs are covered.

2. What about My Debts?

Let’s say that you have enough income coming in for the basic needs. But you might not have enough to cover all the minimum payments on all your debts.

One option of course is to prioritize your debts and spend your disposable income until you run out of money. This means that someone you owe won’t get paid this month.

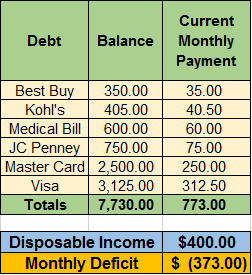

For example, let’s say that after all your basic needs are covered you have $400 left in disposable income but the sum of all your minimum payments exceed that amount.

Here is the scenario:

In this scenario, you have a monthly deficit of $373. You can only cover the first four payments on the list and partially the payment for the Master Card. Visa it’s below the line and gets nothing (actually, that’s an ideal scenario but that’s a topic for another post).

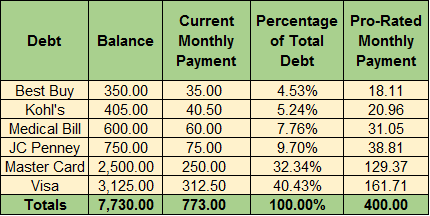

However, another option is to use a “Pro Rata” approach. In this scenario you budget your disposable income and every creditor gets a portion of it according to what percentage of your overall debt they represent:

Here, we have determined what percentage of the total debt each debt represents. We use that percentage figure, and apply it to your disposable income so every creditor gets a monthly payment.

Now it’s possible that they might complain and call about you not making the minimum monthly payment, but they will cash the check.

And remember, this is just a temporary measure while you increase your income. Eventually you will pay every debt on your list and you will move on to bigger and better things with your money.

3. What about Giving?

This is always a great question for dealing with our finances. I always advise to put giving as the first line on your budget.

But sometimes money is tight and you want to give but you don’t see how you can. Let me just remind you of a couple of things as way of encouragement.

First, giving should be a priority not because it’s an obligation but because it’s good for you. No one should give out of guilt or because it’s a rule. There is joy in giving and the amount is not important.

Second, you should only give as you have purposed in your heart. Yes, God loves a cheerful giver, but He also only wants what you have decided from a willing heart (2 Corinthians 9:6-8).

With Him, the condition of our hearts is what matters more than our external actions. If our hearts are in the right place, the right actions will follow.

Question: What other ideas do you have on stretching your income to meet your budget needs?

This post is also available in: Spanish