If you were to ask me what is the key ingredient for financial success, I would tell you the same thing I have told everyone since 2008 when we finished paying-off our consumer debt:

If you were to ask me what is the key ingredient for financial success, I would tell you the same thing I have told everyone since 2008 when we finished paying-off our consumer debt:

The answer is you have to learn how to live on a monthly zero-based budget.

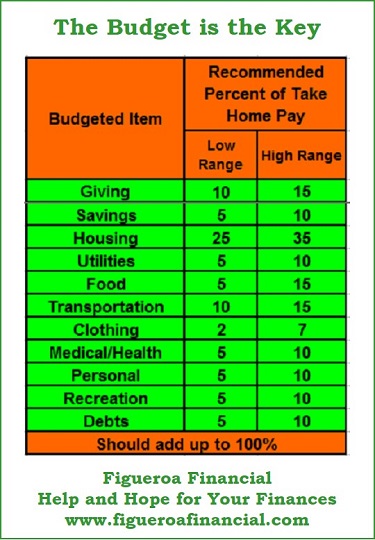

This means that every month before the month begins, you list all of your income on one column, and on the other column you allocate every dollar available to a category.

On your budget sheet, the equation of total income – total expenses should equal zero.

Here is what will happen when you start living on a monthly budget:

- You will be able to tell where your money is going and you will be able to see in which areas you are overspending.

- You will have have the information needed to prioritize your spending and put your basic necessities first (food, shelter/utilities, transportation, clothing).

- As you learn and adjust your spending patterns, you can start to allocate money to emergency savings.

- With your spending under control, necessities covered, and savings built, you can then allocate anything extra to paying-off your consumer debt.

- When you pay-off your consumer debt, you can then start working on saving for retirement and college expenses.

Without a working budget you can’t control your money.

If you can’t control your money, you can’t build savings, you can’t pay-off debt, you can’t plan for the future.

A working budget is the key that will open the door to your financial wellness.

You can start today and I can show you how.

“Economy is half the battle of life; it is not so hard to earn money as to spend it well.”

Charles H. Spurgeon

This post is also available in: Spanish